The fertiliser sector of Pakistan remains a basis of agricultural productivity and food security, with its listed firms on the Pakistan Stock Exchange (PSX) showing solid performance in the month on September 2025.

As of latest data, the fertilizer sector holds a combined market value of $4.6 billion, in accounts for 7.1% of the PSX’s total capitalisation. Yet, from October 2023 onward, fertiliser shares contributed nearly 14% to index performance.

According to Arif Habib Limited, the profitability of the fertilizer sector has also been strong, recording $489 million in profit during 2024, highlighting its importance for Pakistan’s agriculture-driven economy and stock market momentum.

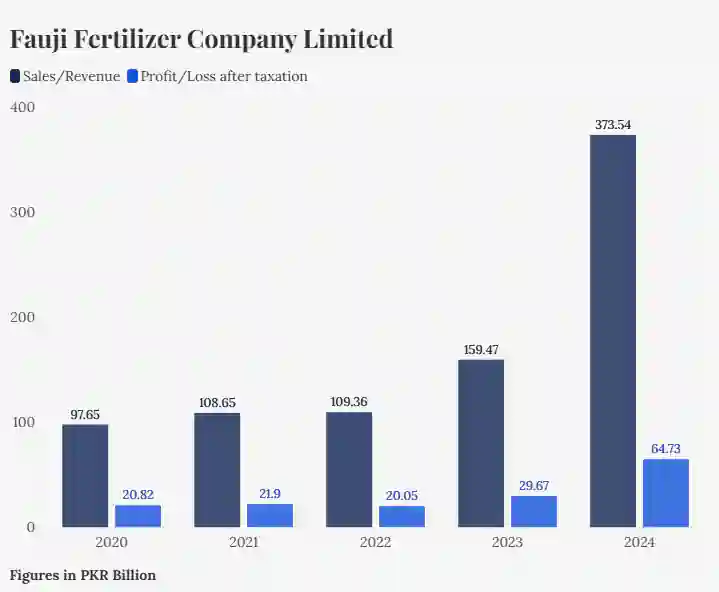

Fauji Fertilizer Company Limited (FFC) ($2,302 million)

Fauji Fertilizer Company Limited (FFC) remains the largest fertiliser firm, with a market capitalisation of $2,302 million as of September 15, 2025. Incorporated under Pakistan’s Companies Act, 1913, (now the Companies Act, 2017), it produces and markets fertilisers, chemicals, and invests across diverse industries.

As of December 31, 2024, FFC reported a total of 1,423.109 million shares outstanding, distributed among approximately 29,400 shareholders. The largest stake, about 43.51%, is held by associated entities and related parties, including the Committee of Administration of Fauji Foundation. The second-largest shareholding bloc is the local general public, which owns 25.06% of the company.

By June 30, 2025, FFC reported Rs38.5 billion in net profit compared to Rs26 billion last year. Earnings per share stood at Rs27, supported by urea production of 1,419 thousand tonnes and sales of Rs155 billion.

The company distributed an interim dividend of Rs12 per share, bringing total payouts to Rs19 per share for the period, with the market capitalisation of the company at the PSX currently standing at $2,302 million.

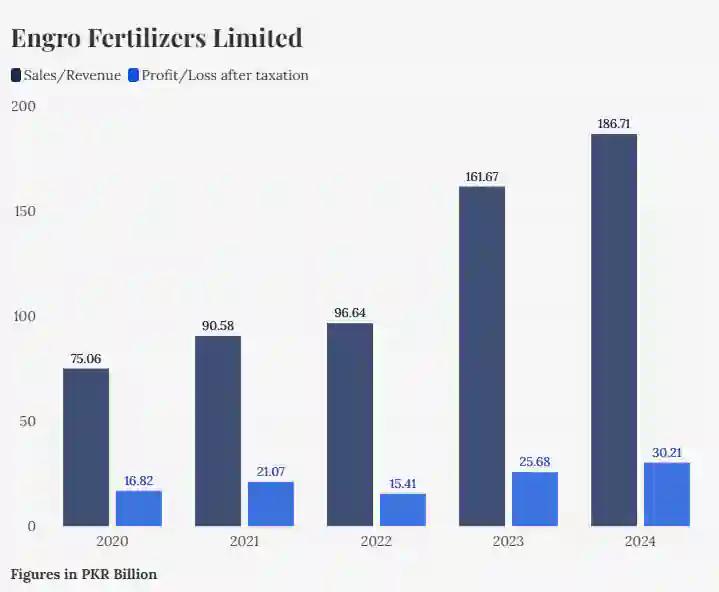

Engro Fertilizers Limited (EFERT) ($1,028 million)

Engro Fertilizers Limited (EFERT), with a $1,028 million market capitalisation, posted Rs2.90 billion profit after tax for the March 2025 quarter, down 63% year-on-year basis.

The company was formed in Pakistan on June 29, 2009, and totally owned subsidiary of Engro Corporation Limited, which is a subsidiary of Dawood Hercules Corporation Limited.

Engro Fertilizers (EFERT) announced a cash dividend of Rs2.25 per share for the first quarter of calendar year 2025 (1QCY25), despite a notable decline in earnings.

The company reported earnings per share (EPS) of Rs2.17 for the quarter, down sharply from Rs5.81 in the same period last year.

As of now, EFERT’s market capitalisation at the Pakistan Stock Exchange (PSX) stands at $1,028 million.

Fatima Fertilizer Company Limited (FATIMA) ($915 million)

Fatima Fertilizer Company Limited (FATIMA), a joint venture between Fatima Group and Arif Habib Group was formed in 2003, is currently valued at $915 million, operates plants in Multan, Sheikhupura, and Sadiqabad.

As of December 31, 2024, the company had 2.1 billion shares outstanding, owned by 11,652 shareholders. The largest chunk, 43.68%, is held by associated companies and related parties.

Another significant portion, nearly 31%, is owned by the company’s directors, CEO, and their immediate family members.

Fatima Fertilizer announced in July 2025 that it would acquire full (100%) ownership of Fatima Petroleum Company Limited, a related entity.

Notably, the acquisition will be made at face value, meaning the company will pay the original nominal price of the shares rather than their current market value or a premium.

As of Monday, September 15, 2025, Fatima Fertilizer’s market capitalisation stood at approximately $915 million, based on an exchange rate of Rs282 to 1 US dollar.