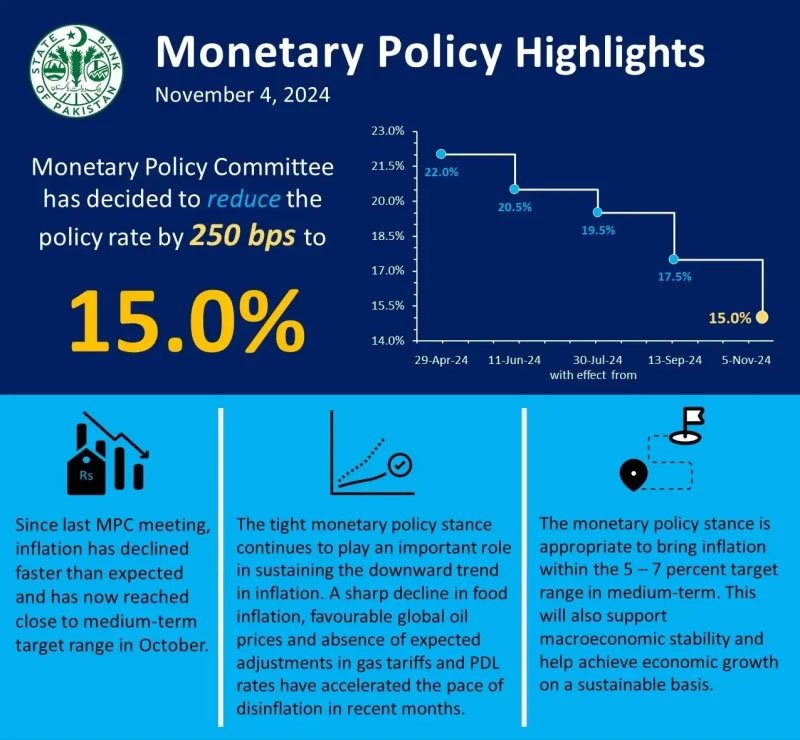

The State Bank of Pakistan’s (SBP) Monetary Policy Committee slashed the policy rate by 250 basis points to 15 percent, more than predicted by the experts.

This recent reduction in policy rate follows a previous 200-basis-point cut in September, lowering the rate from 17.5 percent, the largest decrease since April 2020.

The central bank in a statement cited declining in inflation, which has reached near its medium-term target as of October, as a key factor in the decision.

“The committee noted that inflation has declined faster than expected,” the SBP stated, indicating optimism about achieving a stable economic environment.

This rate cut arrives amid ongoing concerns about Pakistan’s slow economic growth.

Under the International Monetary Fund’s (IMF) bailout program, the country has been navigating strict economic reforms, further straining economic activity.

However, with inflation pressures easing and international oil prices on a downward trend, the SBP’s rate cut aims to stimulate economic recovery and improve financial conditions of the country.

Analysts will watch closely to see if these adjustments support Pakistan’s fragile economy, particularly as the country seeks to balance growth in light of strict reforms under the IMF bailout programme.

Earlier to this, Pakistani rupee is projected to remain stable within the range of Rs277-282/$ over the remaining seven months of the current fiscal year, ending June 30, 2025, defying earlier expectations of Rs300 or higher.

The currency has appreciated by 0.3 percent in the first four months (July-October) of the fiscal year, closing at Rs277.70/$ on Friday, according to Topline Research.

Analysts project that the State Bank of Pakistan (SBP) may reduce its key interest rate by a cumulative 400-500 basis points by the fiscal year’s end, aiming to reach a rate of 12.5-13.5 percent, down from the current 17.5 percent.

Markets expect an immediate cut of 200 basis points on Monday, November 4, following a second month of single-digit inflation, which stood at 7.2 percent in October.

The SBP has already reduced the policy rate by 450 basis points since June 2024, aiming to support economic activity by lowering borrowing costs for businesses.